High-End Hand-Tool Sales Surge

A small band of boutique toolmakers experiences exponential growth fueled, in part, by the Internet

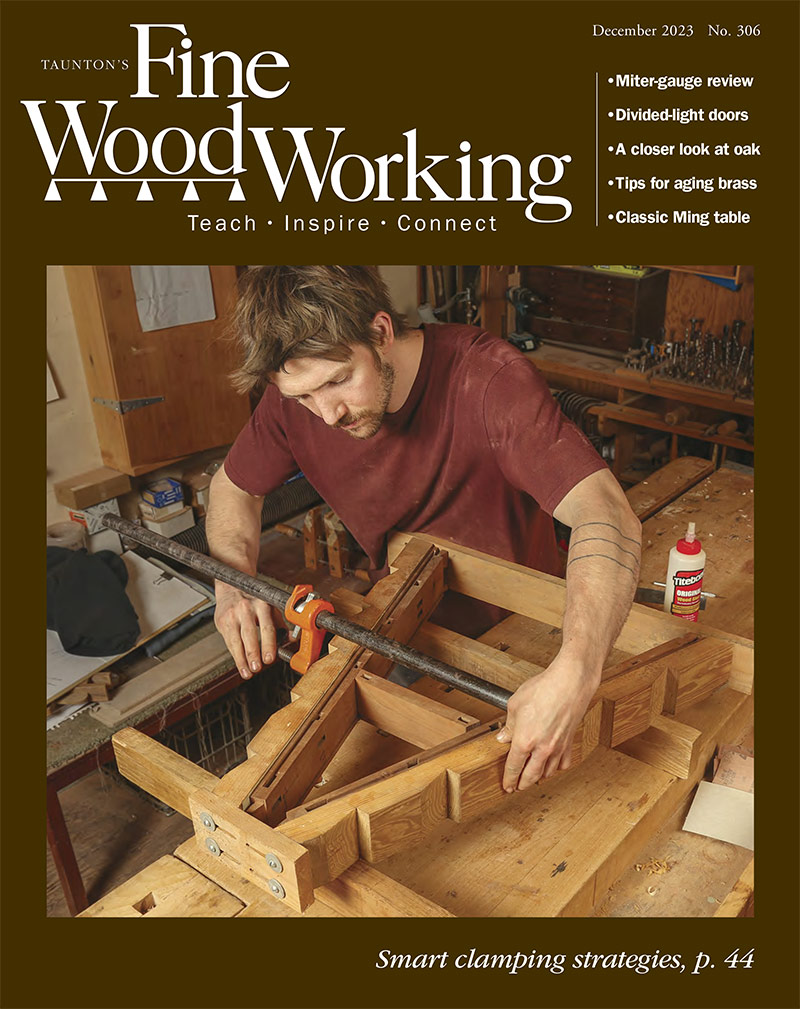

Twenty dollars buys a basic chisel set from a big-box retailer, but it won’t go far at a boutique like Blue Spruce Toolworks LLC, where a set of finely crafted dovetail chisels (pictured right) costs more than 10 times that amount.

High prices don’t deter sales at Blue Spruce or some other specialty sellers such as Sauer & Steiner Tool Works or Wenzloff & Sons Saw Makers. These newcomers to the hand-tool business are experiencing such success that they are struggling to keep up with demand. Their expanding sales are fanned by easy marketing through the Internet and retiring baby boomers plenty of free time and disposable income.

In an era when the big toolmakers hold down costs by manufacturing their products in countries with cheap labor, the boutique manufacturers have a flourishing market for tools crafted in the United States and other countries where labor costs are high.

Focus on quality, not costs

At Sauer & Steiner Tool Works, Konrad Sauer makes every plane himself at his home shop in Kitchener, Ont. He started the business with a partner, Joe Steiner, but took over as sole proprietor in 2003. Sauer now builds about 40 planes a year, crafting them from exotic woods like ebony and rosewood, even customizing them to the shape of the buyer’s hand.

Test drive. Sauer shows off his custom handplanes at a tool show in December.

His average plane sells for about U.S.$3,100 and takes around one week to make. A larger plane, like the 28-1/2 in. jointer that he’s developing now, takes a full three weeks to build and will sell for over $9,000.

The price for just one of Sauer’s planes could go a long way toward outfitting a complete wood shop, but Sauer said he’s seen incredible growth since he started selling tools on his own. He’s now working at maximum capacity. Interested in one of his planes? Be prepared to wait. He’s booked for the next year to year and a half.

Saw maker Mike Wenzloff, of Forest Grove, Ore., tells a similar story. “What I’ve seen in going on three years is more of an exponential rise rather than a flat linear rise,” he said in a phone interview.

Modern maker/classic designs. Wenzloff sells this carcass saw patterned after one built by 18th-century saw maker John Kenyon. Read a subscribers-only review.

Orders roll in so fast that his shop is behind by about 3,000 custom saws and about 500 saws for retail orders. His saws sell for $125 to $300, on average, and he’s working on several 5-ft.-long pit saws that will cost more than $1,000 each.

In Oregon City, David H. Jeske also sees growth for his company, Blue Spruce Toolworks. He makes dovetail chisels and marking knives, as well as components and products for other toolmakers. In a phone interview, Jeske said his business has nearly doubled each year since he started selling marking knives in 2002. His company began as a sideline but grew into a full-time job by 2005. He has produced more than 10,000 tools since then. On average, his products cost $45 to $65. A dovetail chisel set sells for more than $200.

In spite of strong performance among these boutique makers, the niche market is obviously small and in a different league from big manufacturers like Stanley Works, which sell tools by the trailer-load at discount home centers.

Swift sales for some industry stalwarts

It’s not only the newcomers are doing well. Lie-Nielsen Tool Works, an industry mainstay since 1981, has seen annual growth averaging 10% to 15%, according to founder Thomas Lie-Nielsen. The business started as a one-man operation and now employs 78 people. It made over $5 million in sales last year and sold more than 50,000 hand tools, said Lie-Nielsen.

Connecting to customers. Lie-Nielsen, right, with daughter Kirsten, talking to a customer at a show near Boston in December.

The same year that Lie-Nielsen founded his Maine-based enterprise, Ron Hock started selling his own tools in Fort Bragg, Calif. Hock still crafts handplane blades and other tools in his backyard shop, but sends the majority of production to a family-run factory in France, which helps him keep up with demand.

This industry veteran also reports expanding sales, though he wouldn’t share concrete numbers with FineWoodworking.com. “I’m seeing that the market is willing to expect better quality and willing to pay for it and I couldn’t be happier about that,” he said. His next venture is putting out a set of carving knives in partnership with Woodcraft Supply LLC this spring.

Internet spurs hand-tool market

The Internet plays a tremendous role connecting these specialty toolmakers to customers. “Without the Internet, there is no way that a small company like mine could do it,” said Jeske in a phone interview. In fact, he gives the Web partial credit for giving him his start. When Jeske was learning to hand-cut dovetails, he made his own marking knife. When he showed it off in an online forum, others showed interest and business took off from there.

The Internet allows for easy marketing on a budget. The costs of traditional marketing– advertising, direct mail, and printing catalogs–can be prohibitively expensive for a small business. A Web site, on the other hand, is relatively cheap to develop and maintain. Word-of-mouth marketing is even easier online because people connect through an array of woodworking forums and blogs.

Hock, the plane-blade maker, also credits the Internet for much of his success. A woodworker can find immediate information online, by asking a question in a forum or reading a Web article. This on-demand access has stoked hand-tool interest and a renaissance in woodworking in general. “It’s phenomenal,” said Hock.

Hock uses the Internet to teach people about his blades, saying that “the best kind of marketing is bottom-line education.” Customers can’t buy Hock’s tools directly through his Web site, yet he’s amazed at the amount of traffic he still gets from people reading up on his products and watching his videos. “To me that is an incredible amount of time that I get to spend with a potential customer,” he said.

Retiring boomers key factor in growth

The Web lets toolmakers reach buyers in unparalleled fashion, but the sales boost would be impossible without an interested audience. Enter the baby boomers who are beginning to retire with money to spend and time to devote to hobbies.

Tim Rinehart, senior product manager at Woodcraft Supply, said he’s seen the company’s high-quality hand-tool sales increase significantly over the last six to 10 years, a trend that he attributes that to the boomers maturing in their woodworking hobby. While many woodworkers of the baby boomer generation started out with an abundance of power tools, as they progressed in woodworking, they’ve come to see that there’s a place for hand tools, Rinehart said.

David Trusty, of Galgate, England, is an example of one power-tool woodworker who became a hand-tool aficionado after he retired and got a broadband connection a couple years ago. Forum users waxing lyrical about hand-tools quickly convinced him to give them a closer look and he has since amassed a solid collection of premium hand tools including planes from Marcou Planes, Lie-Nielsen, and Veritas, saws from Wenzloff, and chisels from Blue Spruce and Two Cherries.

The future for hand tools?

Boomers like Trusty are only starting to retire, so the up-tick in high-end hand tool sales may be sustained for some time. What comes next is the big question. Many of the boomers got an initial taste of hand-tool woodworking through public schools. Since shop classes are increasingly cut from school curriculum, it’s unclear how future generations addicted to video games and electronic gadgets will get involved in this age-old craft.

Wenzloff, for one, is very optimistic that his saw business will continue to expand, but he acknowledges that there are challenges ahead. “Our need is for new people to enter the craft,” he said, “and the rest will sort itself out.”

Photos: Thomas McKenna and Gina Eide

Log in or create an account to post a comment.

Sign up Log in